Does Middle Class Life Cost More Today?

Costs, 1995–2015

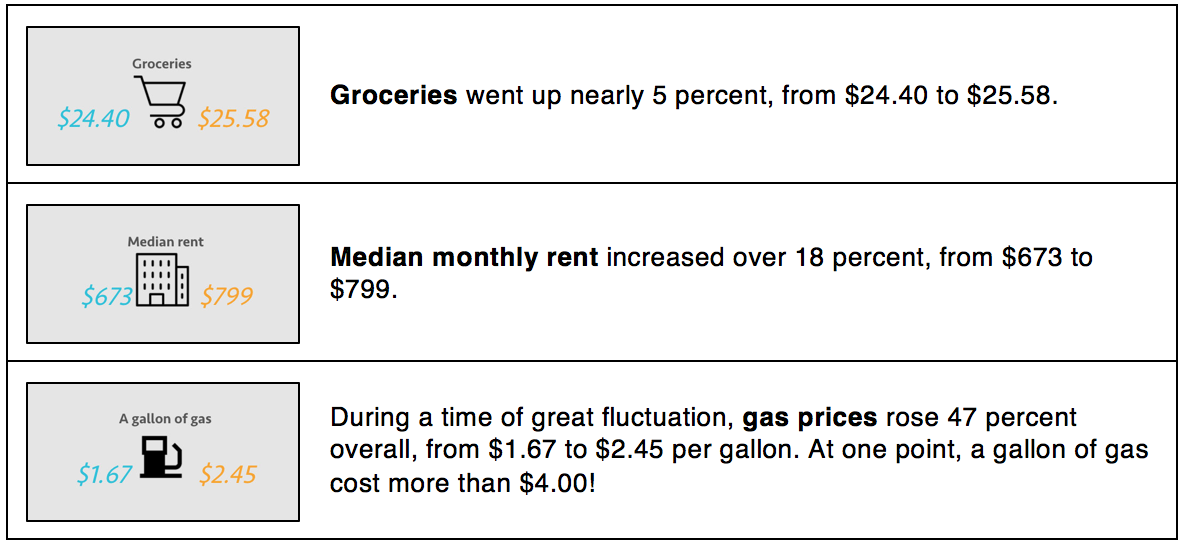

Over the 20-year period between 1995 and 2015, costs in different spending areas have changed. Consider these basic needs: food, shelter, and transportation. Note: All costs cited below have been adjusted for inflation, which allows us to convert historic prices into their equivalent in today’s dollars. Source: Marketplace, using data from the U.S. Bureau of Labor and Statistics and other sources.

Next, consider these aspirations. Aspirations in this context refer to leisure activities, possessions, or opportunities that people may not need to survive yet are commonly associated with middle class life.

The study that produced this data showed that, combining all categories, middle-class costs rose 30 percent over those two decades.

Household Income, 1995–2015

Now examine the following graph, which shows what happened to household income over that same time. While household income was up overall, how was it in 2015 compared with what is was in 2000? Note: Shaded areas indicate U.S. recessions, or periods of temporary economic decline.

Median U.S. Household Income in Dollars, 1995–2015. Source: U.S. Bureau of the Census and fred.stlouisfed.org

How do you think middle-class spending behaviors might change when prices rise and wages don’t keep up? Use Arrange It to predict the effects of some of these changes.